Year-to-date healthcare debt issuance is down almost 30% versus the same period in 2021 and currently stands at only 43% of full year 2020 issuance and 55% of full year 2021. Certainly, market disruptions are a key factor, but the primary driver has been the credit dislocation rocking the sector during 2022. Eventually, this dynamic will shift, and healthcare organizations will re-engage in funding capital projects or shoring up balance sheet liquidity, and leverage will be an important part of those initiatives.

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

Oct 28—UST |

4.53% |

4.18% |

4.01% |

4.14% |

|

v. Oct 14 |

+7 bps |

-9 bps |

-1 bp |

+15 bps |

|

Oct 28 – MMD* |

3.14% |

3.24% |

3.41% |

4.14% |

|

v. Oct 14 |

+21 bps |

+24 bps |

+26 bps |

+38 bps |

|

Oct 28—MMD/UST |

69.3% |

77.5% |

85.0% |

100.0% |

|

v. Oct 14 |

+3.6% |

+7.3% |

+6.7% |

+5.8% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 2.24%, which is approximately 60% of 1-Month LIBOR and represents a -19 basis point adjustment versus the October 12, 2022, reset.

Refining Your Capital Structure Point of View

The inevitability of external financing paired with rapidly shifting internal and external conditions raises the importance of testing and refining your capital structure point of view. And doing that always starts with the principle that capital structure management is grounded in risk management:

- How much capital structure risk can/should your organization retain (based on credit factors and total enterprise risk factors)?

- What is the benefit of retaining capital structure risk or the cost of transferring risk (based on current and expected market levels)?

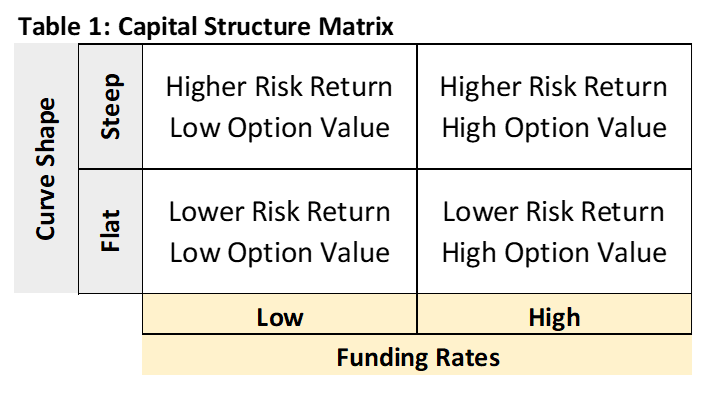

The first cost-benefit lens is absolute rates and the prevailing yield curve, which collectively frame how much you might get paid to take risk or how much it costs to sell risk. But cost in the moment must be measured against rate expectations and the implicit value of restructuring optionality. A high-risk debt portfolio (all floating rate) has maximum restructuring optionality, whereas a low-risk portfolio can be restructured only at call dates or by using derivative products (swaps to overlay specific risks). From mid-2020 through the end of 2021, we were bouncing between the left two quadrants of Table 1, but the consistent position management choice was to transfer risk and trade optionality for low rates. It feels like we have moved into the lower right quadrant in which risk is re-entering the discussion but more as the gate to restructuring optionality versus economic benefit, at least in the near-term.

I say “it feels like” intentionally—the curve is flat and while rates have moved up sharply during 2022, they have been higher before and could move higher from here. The closing rate for 30-year Treasuries on October 27, 2022, was 4.08%, which is a whopping 218 basis points higher than the close on December 31, 2021. Since my first day working in healthcare finance—June 25, 1984—the average rate has been 5.39%. From my start date to the end of 2007, the average was 6.85%; and from 2008 to present the average has been 3.12%. 2008 saw the emergence of a totally different Federal Reserve engineered rate regime; if this is the road map for the future, then perhaps 3.12% is a reasonable baseline proxy, in which case current rates are very high and optionality is critical. But as the Fed unwinds its current position, perhaps 4.33% is low and optionality is over-rated, especially if inflation proves intractable (think 1970s) or the liquidity unwind moves us closer to a pre-2008 Fed presence.

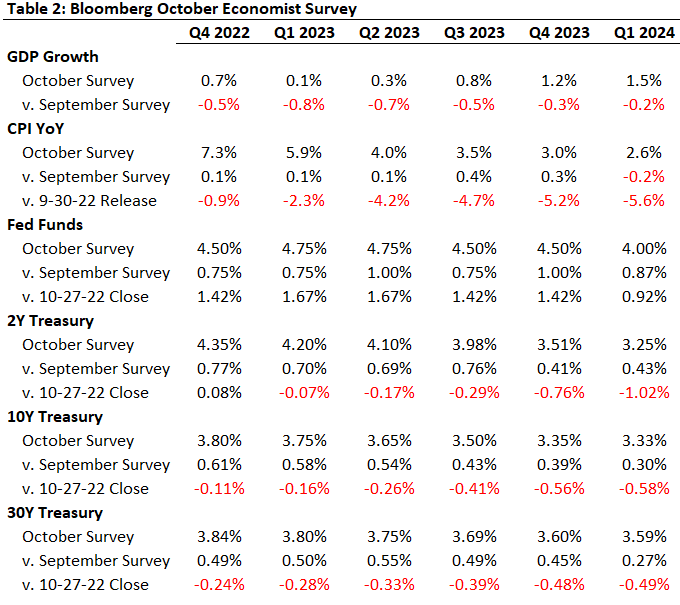

The value of optionality is a question borrowers will need to grapple with for the foreseeable future, at least until we learn which Federal Reserve bookend represents “stability.” Table 2 highlights results from Bloomberg’s October survey of Wall Street economists as well as the shift versus the September survey. Set against current levels, results suggest that inflation will abate dramatically, Fed policy will moderate, and recession or slow growth will drive long rates lower. This suggests value in either deferring borrowing or retaining optionality. But what also jumps out is the magnitude of monthly changes—what does it mean when the experts adjust their views by 50 to 80 basis points higher over the course of a single month? It seems like economists have been chasing markets for most of 2022 and that any consensus doesn’t sit on solid ground. Remember, we live in the “never done that before” era, which elevates the value of smart and strategic—versus transactional—thinking that is grounded in a well-articulated point of view.

We are in a very complicated credit moment and an equally complicated capital structure environment. Capital access remains a critical success factor, and today’s work is to reassess where you want to be on the risk-optionality continuum, whether you have the credit and risk capacity resources needed to shift toward risk, and what this means for capital structure transactions. Which markets do you fund in (public or private/tax-exempt or taxable)? What tenors do you target? Do you issue long fixed, intermediate fixed, or floating? Will derivatives re-emerge as part of your playbook? The landscape has shifted, and it is time to dust off debt policies and reassess how to position this part of your business.