Current Funding Environment

Healthcare debt issuance remains incredibly light. How long can a capital-intensive industry tolerate limited capital generation? Is pressure building to some tipping point when the need for capital and liquidity will outweigh defending a credit-rating position or avoiding what seems like high-cost debt? The sector generated a lot of internal and external capital in 2020-2021, but the falloff across all channels has been dramatic and residual resource positions are deteriorating.

|

1 Year |

5 Year |

10 Year |

30 Year |

|

|

Feb 24—UST |

5.05% |

4.21% |

3.95% |

3.93% |

|

v. Feb 10 |

+15 bps |

+29 bps |

+21 bps |

+10 bps |

|

Feb 24–-MMD* |

3.03% |

2.61% |

2.59% |

3.56% |

|

v. Feb 10 |

+42 bps |

+49 bps |

+35 bps |

+28 bps |

|

Feb 24—MMD/UST |

60.00% |

62.00% |

65.57% |

90.59% |

|

v. Feb 10 |

6.73% |

7.91% |

5.68% |

4.95% |

|

*Note: MMD assumes 5.00% coupon |

||||

SIFMA reset this week at 3.42%, which is approximately 74% of 1-Month LIBOR and represents a -32 basis point adjustment versus the February 8, 2023, reset.

The Need for Enterprise Performance Improvement

Recent economic releases—jobs report to CPI to PPI to retail sales—all suggest that the Federal Reserve’s efforts to bring inflation into line are yielding slower than hoped for results. The expectation is continued Fed tightening (higher rates), with a range of voices suggesting the Fed will be forced to push rates high enough to trigger a recession. Every restaurant and shop in the small town I live near has a “we’re hiring” sign in its window and each was jam-packed with very active consumers this past Presidents’ Day weekend. If success in taming inflation requires a broad-based hiring and economic slowdown, it feels like we have a long way to go.

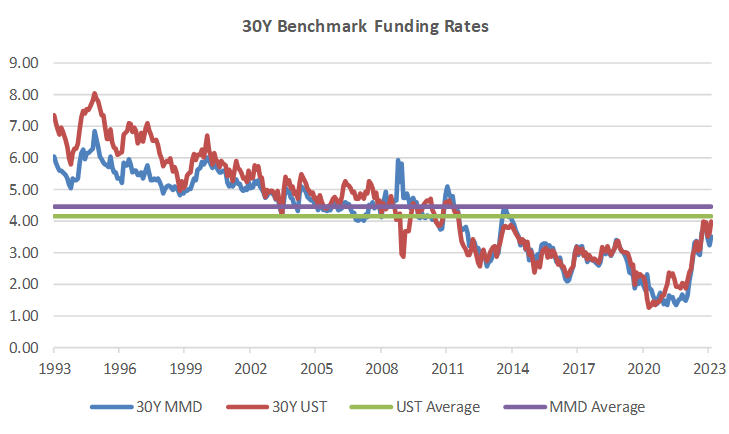

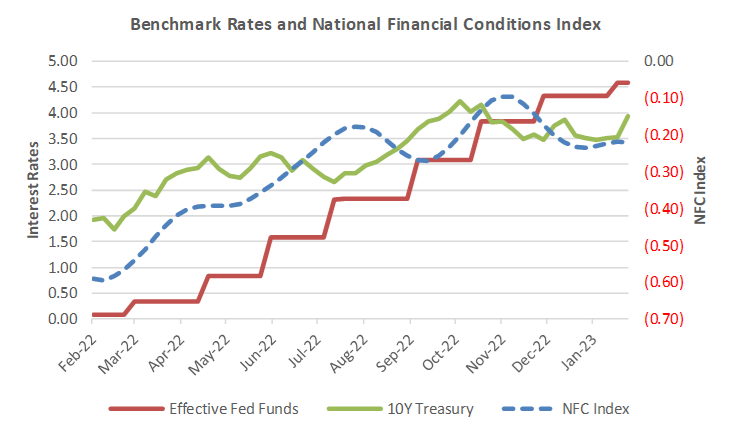

Markets keep doing their thing, which frequently seems disconnected from the Fed’s thing. Both 30-year Treasuries and MMD are just starting to bump up against 30-year averages, the 10-year Treasury has moved higher over the past several weeks but remains below Effective Fed Funds, and the Chicago Fed’s National Financial Conditions Index continues to suggest relatively accommodative overall financial conditions.

While I question the depth and reliability of fixed income markets, the funding environment doesn’t seem as bad as the very low debt issuance activity would suggest. Channeling Shakespeare, it seems that “the fault, dear Brutus, is not in our stars, but in ourselves,” meaning that low debt issuance is coming out of healthcare’s very profound resource problem rather than externalities. I concluded a long time ago that not-for-profit healthcare credit and capital management is about strategic resource allocation. Healthcare leaders continuously rebalance the allocation of resources embedded in operations, credit position, and retained fixed and financial assets; and there has never been as challenging a resource generation and allocation moment as the one we are in and are likely to remain in for an extended period.

The scary version of all this is that not-for-profit healthcare has entered a resource chasm that will fundamentally degrade the sector’s credit and capital foundation. COVID and inflation have combined to expose the brittleness of the healthcare resource chassis. The engine—operations—is bumping up against the dual pressures of:

- Labor-scarcity-driven strains on converting customer demand into realized financial resources; and

- A business model that doesn’t allow the efficient transfer of increased costs onto customers.

The result is unprecedented resource compression that leads to dramatically lower internal and external capital formation; existential covenant threats; and the temptation, if not the necessity, to use retained wealth (i.e., spend down balance sheet) to support current operations versus funding growth or protecting long-term resiliency.

Every organization must aggressively identify and pursue operating performance improvement initiatives. But every organization needs to extend the idea of performance improvement to balance sheet, with the goal of addressing three total enterprise considerations:

- What Is Our Resource Portfolio? What is the catalogue of resources available to the organization? What form are those resources in? What is the roster of demands on those resources and is there balance or imbalance between the two? What are the consequences of imbalance and the costs of moving to balance?

- What Are Our Resource Priorities? How dependent is your organization on balance sheet to achieve success? Is balance sheet a critical liquidity or credit buffer against elevated operating and strategic volatility—the bridge between today and a successfully implemented operations performance improvement plan? Is it a source of external capital to fund strategic initiatives or defend overall liquidity? Is it an actual funding source and is this a departure from past practice? Is it an independent and alternative source of (non-operating) cash flow? Is the balance sheet role changing and what does that mean to operations, credit, resiliency, etc.?

- How Should Our Resources Be Positioned? Are balance sheet resources in their best form or is there a benefit from converting them into something different (like cash)? Will performance improvement initiatives alter positioning conclusions and, if so, does that improvement occur over an acceptable time frame? Can various resources be successfully converted today or are there cost or other impediments?

The need is to move out of siloed and into integrated and enterprise-centric performance improvement, which requires one consistent resource allocation mindset applied across operations, liabilities, real estate holdings, financial asset holdings, and every other class of organizational resources. The need is to transition from thinking that balance sheet and operations can be disconnected thoughts to seeing them as two sides of the same coin.

Covenant threats continue to escalate, all centered on how reduced resource generation impacts debt service coverage. We reiterate that it is critical for every organization to understand how its specific covenants work and to have a rolling forecast on expected performance. As an example, many organizations now have coverage covenants where default requires two consecutive years of below the coverage ratio. This is an unconditionally good thing, but many of these same organizations may face a consultant call-in at year one and some of them may also confront year-two limitations on additional debt, merger, sale, disposition of assets, and a host of other important management levers. So, the good thing has conditions that are essential to understand and, perhaps, get ahead of. We have a robust library of covenant-related thought leadership on our website—ranging from written content to webinars—and our team is always ready to help.