Another quiet couple of weeks in the healthcare funding markets. Markets remain unsettled and not-for-profit healthcare issuance remains light.

We are a little past the midyear mark and I thought it might be helpful to assess where we are from four different angles. Unfortunately, there isn’t much good news. But first, a few things to call out:

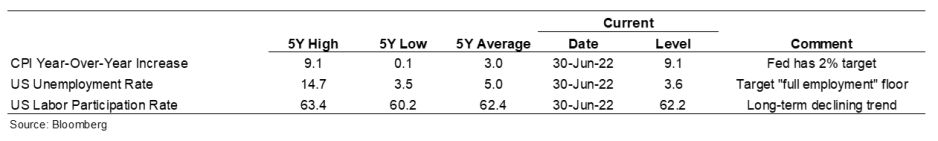

- Labor Is a Mess. I talked about this in my June 18th blog, which I would supplement with James Piereson’s recent opinion piece in the July 14 Wall Street Journal titled “Welcome to the Full Employment Recession”—it offers a helpful profile of long-term trends in both the size of the U.S. labor force and participation rates. This is the central “near” challenge in front of every U.S. business, large or small. And it does seem feasible that this problem sets us up for challenges like Piereson’s full employment recession or stagflation (inflation but no growth).

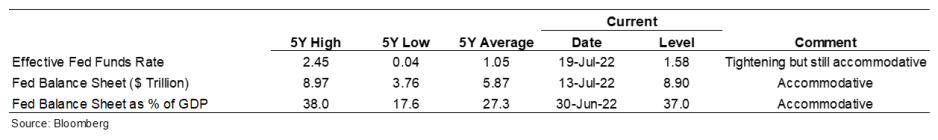

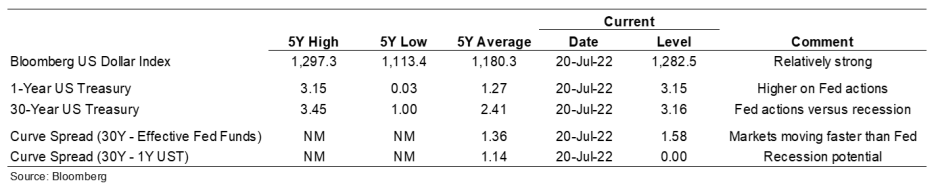

- The Fed Is Driving. The Fed is poised to undertake additional tightening, with some speculation that their next move might be a 100 basis point increase. Inflation remains high; benchmark rates are higher, and curves are flat; equities remain volatile; and the dollar is strong. The Fed continues to lead the parade and it will be a long time before that changes.

- Pogo Lives. Over the weekend I listened to a rebroadcast of American Top 40 from July 16, 1976, and learned that the #1 hit for the second week in a row was “Afternoon Delight” by the Starland Vocal Band. Many of you might know the song through the Anchorman rendition, and while I was around for its 1976 launch into popular culture, I had no idea that it reached #1 on anything other than the ridiculous chart. After a good laugh, I realized that “Afternoon Delight” getting to #1 is a microcosm of our current problem: “we have met the enemy and he is us.”

Here are the four angles from which to assess our current situation:

- Inflation—Labor Context: Not much good news on this front. Despite hints of moderating inflation, posted rates in the U.S. and globally have continued to reach new highs. Labor participation remains a major headwind, especially for sectors like healthcare that have significant reliance on “specialty” labor pools. Remember, the Fed built a policy it thought was responsive to its dual mandate of price stability and full employment. But what is full employment in a declining workforce world? How do you fulfill a mandate when the goal is shifting?

Image

- Federal Reserve Position: The Fed’s tightening journey continues. Market participants expect another 75 basis point rate hike, with some forecasting a full 100 basis point move. Fed-speak is prioritizing price stability (getting inflation under control), even at the cost of recession and higher unemployment. That said, the Fed balance sheet remains elevated both on an absolute basis and relative to GDP. Some express concern that the Fed will go too far too fast and push us into an otherwise avoidable recession; but maybe recession—if it comes—is just a down payment on the long-term price we will all have to pay to rebalance the Fed’s role in the economy (which takes you back to Piereson’s idea of full employment recession).

Image

- Key Benchmarks: Key benchmarks reflect expectations for continued Fed tightening. The dollar has strengthened significantly versus other major currencies, in response to forces ranging from geopolitical dislocation (Ukraine) to the Fed adopting a significantly more aggressive tightening regime than the European Central Bank or the Bank of Japan (the latter has said they have no plan to move off their accommodative stance). The European Central Bank just announced an unexpected 50 basis point rate hike—which seems more about currency defense than reprioritizing to address inflation versus spur growth. The flat Treasury curve frames the tension between expected Fed rate hikes versus the concerns that these actions will trigger a recession.

Image

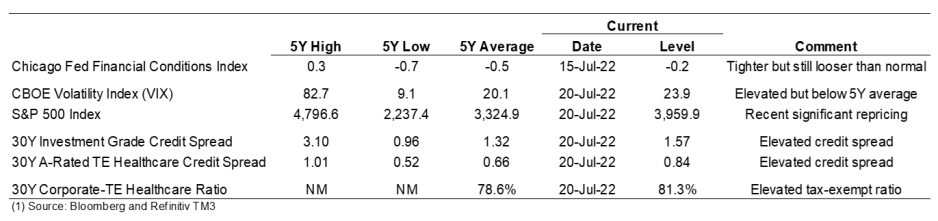

- Risk—Funding Environment: As expected, financial conditions have tightened, but the Chicago Fed index suggests that, on balance, things are still somewhat more accommodative than not. Risk indicators across various markets remain elevated and every balance sheet function—borrowing and investing—is likely to remain challenging. Equity markets can seem like an arcade during a financial pinball tournament: inflation numbers get reported and risk markets wig out; then earnings periods roll around, and everyone searches for the rationale to re-risk.

Image

There is no haven, and stability across any part of the healthcare enterprise sees like a distant promise. We continue to advocate three things that will pay dividends whether we stay in scarcity or transition to growth:

- Round up the usual performance improvement suspects and work on moving to another level in critical areas like revenue cycle, labor productivity, supply chain, clinical documentation, etc.

- Rethink performance optimization and test the possibilities around key areas like nursing or non-nursing workforce, care transitions, care variation, or service redesign.

- Adopt a relentless resource allocation focus and test both defensive positioning options (around liquidity and balance sheet management) as well as accretive opportunities like real estate optimization, portfolio optimization, partnerships, or alternative revenue channels.

Trending in Healthcare Treasury and Capital Markets is a biweekly blog providing updates on changes in the capital markets and insights on the implications of industry trends for Treasury operations, authored by Kaufman Hall Managing Director Eric Jordahl.