In an August post on our Trending in Treasury & Capital Markets blog, we commented on how one of the movie highlights of the past year—Everything Everywhere All at Once—served as a metaphor for healthcare in 2022 and beyond. One of the movie’s main ideas is that because we are barraged by everything, everywhere, all at once, we need to embrace all our resources, everywhere we can find them, all the time. Over the course of 2022, hospitals and health systems were hit by the Omicron surge, labor shortages, skyrocketing expenses, depressed operating margins, rising interest rates, and investment losses—everything, everywhere, all at once. As we move into 2023, hospital and health system leaders will need to bring the full range of available resources to bear against a continuing barrage of operating and financial headwinds.

Stabilization’s rocky road

Since the pandemic began in 2020, we have been tracking what we believe will be a three-phase path to full recovery. The first phase was crisis, which was largely a monetary event marked by stimulus funding and a loosening of the already accommodative monetary policy that the Federal Reserve has pursued since the Great Recession. The second phase is stabilization, and in our 2022 outlook, we predicted that we were entering this phase. The stabilization phase is largely a credit event, a time of coming to terms with the financial and credit implications of the crisis phase. We noted that the stabilization phase might be volatile and would likely extend over a several year period, and the inflation and labor dislocations of 2022 capture this idea. As we start 2023, we clearly remain some distance from reaching the third phase of normalization.

Our 2022 outlook also spelled out a worst-case scenario for the year, in which the income statement would remain under pressure and the balance sheet, which has been the resiliency anchor for many hospitals and health systems, would also come under pressure. Unfortunately, this scenario came to pass, with a combination of weak operations and pressured balance sheets resulting in a worsening credit environment. As of December 2022, all three of the major rating agencies had a negative or deteriorating outlook for not-for-profit hospitals and health systems.

Stabilization was a rocky road through 2022, and we anticipate continued bumps on the road forward through 2023, including the following:

- An end to the public health emergency. The COVID-19 Public Health Emergency (PHE) that was declared on January 31, 2020, has been regularly extended, but it is likely that it will end some time in 2023. Among the most significant impacts will be an end to enhanced federal funding of Medicaid, and with it, an end to the requirement that state Medicaid programs keep people continuously enrolled through the end of the month in which the PHE ends. Impacts will vary by state, but to the extent disenrolled individuals do not purchase health plans on the individual state exchanges or enroll in high-deductible plans, hospitals and health systems may experience a rise in bad debt and charity care and see patients delaying care. One bright spot: the omnibus spending bill that Congress passed in December extended the PHE waivers for telehealth and the CMS Acute Hospital Care at Home program through the end of 2024.

- A lack of government support. We do not anticipate that the federal government, in its role as payer, will be particularly supportive of hospitals in the coming year. While Medicare market basket increases were generally favorable last year, sequestration cuts also were reimposed and as the Fed cools markets and the economy, state income and capital gains tax bases may constrict. At the same time, the Federal Reserve cannot afford to return to an accommodative monetary stance. This means that the biggest balance sheet and the biggest payers in the system will tilt more toward restrictive versus accommodative stances. On a (qualified) positive note, neither political party seems particularly focused on fiscal discipline, so the prospect of something like a Balanced Budget Act 2.0 seems unlikely in the short term. Changes to Medicare could potentially be on the horizon after the general election in 2024.

- Limited relief from commercial payers. Payers are not enthusiastic about reopening contracts before they expire, and some health systems are reporting that rate increases for renegotiated contracts remain well below the rate of inflation.

- Unpredictable volume recovery. Volumes remain choppy and unpredictable for many organizations, which report more medical and fewer surgical cases, elevated length of stay and inability to discharge to post-acute care settings given ongoing labor issues, and growing competition for ambulatory and urgent care, especially in high growth, non-certificate-of-need markets.

- Intractable labor issues. Generally speaking, the Federal Reserve’s efforts to rein in wage inflation with its blunt instrument of interest rate hikes seem to be having mixed results, due in part to persistent issues with labor participation. Healthcare has a secondary labor issue in that it is a specialty labor market and for many of its positions cannot simply hire individuals off the street. Technology, strengthening the talent pipeline, or workforce restructuring all are potential mitigants, but none of these options are easy to implement.

- Uncertain investment returns. A potential recession, continued tightening of the Federal Reserve’s monetary policy, and inflation concerns may result in sideways or downward pressure on investment returns in 2023.

- Persistent credit challenges. These challenges will range across a spectrum of outcomes, from credit downgrades to covenant breaches or near misses to—at worst—bankruptcies or facility closures. Financial challenges may push some organizations to find a more stable partner, contributing to a renewed focus on partnerships, mergers, and acquisitions (although these efforts may be constrained by heightened regulatory scrutiny of M&A activity across many industries, including healthcare).

- A higher interest rate environment. Markets anticipate that the Federal Reserve will continue to raise interest rates early in 2023 in its ongoing efforts to reduce inflation. While rates are higher, it is also worth noting that they are not abnormal by historical standards.

- Challenges in the taxable debt market. Access to taxable debt markets will become more challenged. Investors in this space are seeking yield and will move on if the waters look choppy. Not-for-profit investors typically have greater familiarity with the industry and are more tolerant of periods of pressured operating performance.

Balance sheets will continue to play a critical role in bridging organizations from the stabilization phase to the third phase of normalization, when operations return to some level of stability or organizations have learned to adapt to their operations running at a new, lower-margin level. How this is accomplished, however, will require a thoughtful and proactive response that balances protection of the enterprise against pursuit of potentially risky strategic initiatives and returns.

How hospitals and health systems should respond

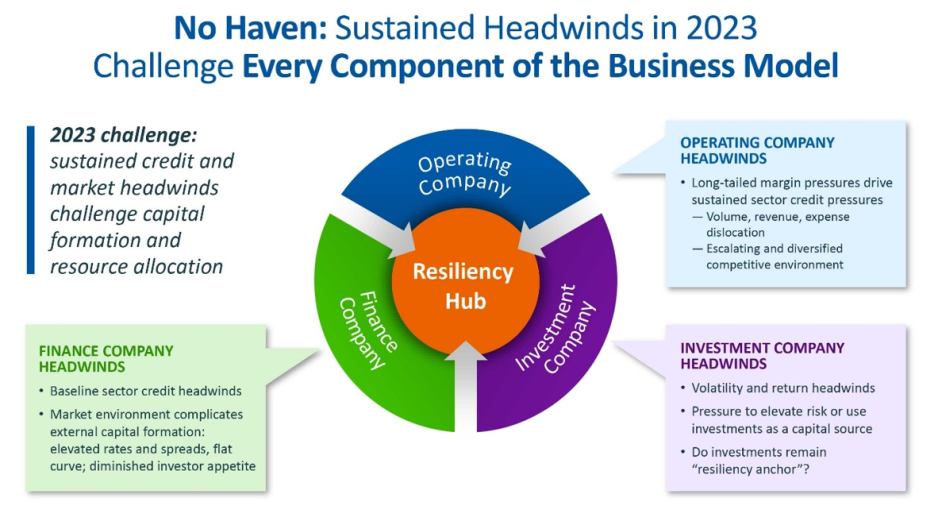

We often describe not-for-profit healthcare systems as a combination of three companies: an operating company, finance company, and investment company that work together to, first, pursue the organization’s mission; second, build organizational resiliency; and third, pursue returns. Today, all three companies are under pressure (Fig. 1). We already have described many of the pressures on the operating company. Pressures on the finance company can be illustrated in one comparison: in 2020, there was approximately $52 billion total debt issuance in healthcare, an historically high level fueled by an extraordinarily accommodative monetary policy at the Federal Reserve. In 2022, as that policy was reversed, there was approximately $28 billion in total healthcare debt issuance, an historically low level.

For the first time in a long time, the investment company must become a new area of focus for organizational decision-making, even as it too has come under pressure with investment losses. Most not-for-profit health systems have for many years enjoyed a one-way flow of resources into the investment company. Must they now reverse some of that flow out of investment portfolios to fund key strategic initiatives and capital needs? Do they take more risk in their investments to try to create better investment company returns? Or do they de-risk on the investment side because of ongoing operational risk and focus on less risky strategies?

We believe that hospital and health system leaders face a decision tree in the year ahead:

- One branch requires repair of operating company performance, which will take time.

- Another branch is whether to liquidate investment resources and spend down resources to stay on course with strategic and capital spending needs, realizing that this will make the balance sheet less resilient and possibly shorten the time the organization has available to reach the normalization phase in operations.

- A third branch is whether to turn to the finance company to pursue external funding, pushing the leverage button because leadership feels it cannot afford to deplete its investment portfolio or reduce its strategic and capital spending.

- A final branch is to continue holding one’s breath. But as the heroine of Everything Everywhere All at Once quickly learns, you cannot hold your breath forever when you are getting hit on all sides.

There is no single correct answer for all hospitals and health systems. There is, however, a common need to identify the path that leadership feels will best position the organization for long-term resiliency and growth. We recently described the 2020s as “the era of great resource allocation” for healthcare leaders. Thriving in this era will require excellence in both generating resources wherever possible in the organization and appropriately positioning those resources on the resiliency-to-return continuum.