October was a challenging month for hospitals and health systems nationwide amid ongoing instability spurred by the COVID-19 pandemic. Margins and volumes fell, revenues flattened, and expenses rose as COVID metrics continued to climb and some states moved to retighten social distancing guidelines. As of Oct. 31, the number of daily U.S. COVID cases reached a high of more than 90,500 and related hospitalizations surpassed 47,400.

Margins have been down consistently year-to-date (YTD) since the start of the pandemic, but have fluctuated from month to month. Even with emergency FDA approval of a vaccine, October’s downturn likely will continue as COVID rates rise throughout the fall and winter. Hospital and health system leaders are bracing for difficult months ahead, as the combined forces of the pandemic and seasonal flu drive many individuals, and local and state governments to recommit to stricter preventive measures, causing many to delay non-urgent procedures and outpatient care. The result will exacerbate volume declines and could further destabilize hospitals financially, with a potential return to the significant losses seen in March and April.

Eight months into the pandemic, the Kaufman Hall median Operating Margin Index* remained below 2019 performance at 2.4% YTD through October with CARES Act funding, and -1.6% without CARES. The Kaufman Hall Operating EBITDA Margin Index was 7.3% YTD with the federal aid and 3.8% without CARES.

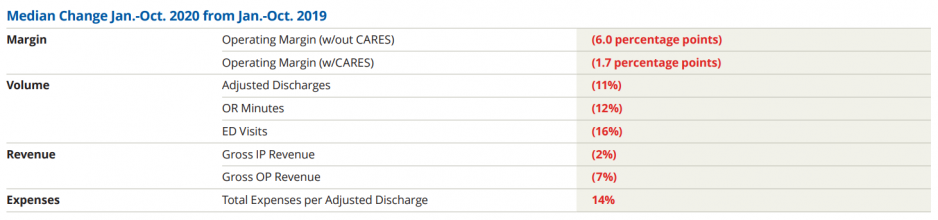

October margins were down compared to 2019 measures, but above budget. Operating Margin fell 69.4% YTD (6.0 percentage points) and 9.2% (1.4 percentage points) year-over-year (YOY), but was 5% (0.5 percentage point) above budget, not including federal CARES funding. Operating EBITDA Margin fell 41.6% YTD and 9.8% (1.7 percentage points) YOY, but was 3.1% (0.3 percentage point) above budget without CARES. With the federal relief, Operating Margin fell 18.7% YTD (1.7 percentage points) and 8.5% YOY (1.2 percentage points), but rose 6.8% (0.7 percentage point) above budget. Operating EBITDA Margin declined 12.8% YTD and 8.1% (1.5 percentage points) YOY, but was 4.2% (0.5 percentage point) above budget with CARES.

Rising expenses and an eighth consecutive month of shrinking volumes contributed to October’s poor margin performance. Adjusted Discharges fell 11.2% YTD, 9.3% YOY, and 5.5% below budget, while Adjusted Patient Days decreased 7.7% YTD and 2.9% YOY, but were up 1.4% above budget. Operating Room Minutes fell 11.7% YTD and 5.6% YOY, as patients continued to delay non-urgent procedures.

Emergency Department (ED) Visits remained the hardest hit, falling 16% both YTD and YOY in October. Hospitals did see month-over-month increases in both ED Visits and inpatient volumes, due in part to rising COVID cases. ED Visits rose 1.9% month-over-month while Discharges were up 7.6%. Hospital leaders should be prepared to see mounting increases as cases escalate in the months ahead.

Gross Operating Revenue (not including CARES) also fell 4.8% YTD and 1.4% below budget, but was flat compared to October 2019 levels— a discouraging sign following YOY increases for three of the last four months. Declining outpatient visits were a major contributor, driving Outpatient Revenue down 6.6% YTD and 2.6% YOY for the month. Meanwhile, Inpatient Revenue declined 2.4% YTD but rose 2.6% YOY.

Expenses continued to rise as hospitals replenished staffing levels in light of rising COVID cases, and incurred the costs of drugs, personal protective equipment, and other supplies needed to ensure safe care. Such increases will put hospitals in a tenuous situation if volumes plummet. Total Expense per Adjusted Discharge rose 13.5% YTD and 12.2% YOY in October. Labor Expense per Adjusted Discharge rose 15.2% YTD and 10.8% YOY, as organizations continued to bring back furloughed employees.

Non-Labor Expense per Adjusted Discharge rose 13% both YTD and YOY, with Purchased Service Expense per Adjusted Discharge seeing the biggest increase at 16.9% YTD and 18.6% YOY. Drugs and Supplies Expense per Adjusted Discharge continued to rise rapidly at 15.1% and 8.9% YOY, respectively. These expenses will increase further as the severity of patients rises, a trend reflected by the 3.8% YOY increase in Average Length of Stay.

The U.S. economy showed some gains in October, with the Gross Domestic Product up 7.4% from the second to third quarters, following a 9% decline between the first and second quarters. The U.S. unemployment rate dropped to 6.9%, its lowest level since March. The Federal Reserve kept monetary policy steady with no changes its bond purchases, promising continued aid to the economy. However, Congress’ failure to pass another stimulus package is causing many observers to question the economic recovery. U.S. Treasury rates increased in volatility prior to Election Day, with 30-year rates hitting their highest levels since March, up 0.20% month-over-month.

The coming months will be critical for our nation’s hospitals, with the virus expected to continue its rapid spread as families gather for the holidays, and activities move increasingly indoors with the onset of colder weather across much of the country. Look for future issues of the National Hospital Flash Report, as we track hospital performance through these very challenging times.

*Note: The Kaufman Hall Hospital Operating Margin and Operating EBITDA Margin Indices are comprised of the national median of our dataset adjusted for allocations to hospitals from corporate, physician, and other entities.

Kaufman Hall is pleased to introduce the Physician Flash Report, featuring insights on current industry trends with national data from nearly 100,000 providers from the Axiom Physician Budgeting Tool.