For hospitals and health systems focused on transforming how they deliver care to their patients and communities, the prospect of merging with a counterpart organization and creating a combined organization better positioned to achieve those goals is an increasingly attractive option. In the third quarter of 2020, Kaufman Hall research identified 19 announced mergers, suggesting that the ongoing COVID-19 pandemic may be strengthening the rationale for new, transformation-focused activity.

But without careful, intentional integration planning from initial discussions around the business case to closing and Day One, merging parties may face a host of unexpected barriers that can dampen the promise of the new organization, including closing delays, unanticipated expenses, care delivery gaps, foregone synergies, disappointed leadership, and regulatory and legal challenges.

Ideally, integration planning starts with the development of a strong business case and continues through the pre-close transition and the onset of the new organization’s combined operation. This approach allows merging parties to craft a common vision for the financial and strategic rationale of the new organization, carefully design its operating and governance models, and successfully function as a single entity on its first day.

Developing the business case

During the initial development of the business case for the merger, parties should take steps to ensure financial planning is fully integrated into the strategic rationale for the partnership, and create a common vision for how the new organization will operate and achieve its goals.

During this stage, organizations begin to define how success for the merger will be measured and document the benefits that staff, patients, and communities will receive. These efforts should include preliminary efforts to identify operational synergies, the development of a potential enterprise operating model for the new organization, and a strategic assessment of the rationale for the combination.

From a financial planning standpoint, organizations should begin to develop financial models highlighting the value created from bringing the parties together. Ultimately, planning during the development of the business case is intended to inform leadership and board-level decisions regarding the question of whether to move forward with a letter of intent (LOI).

Planning the transition

After the LOI is in place, merging entities should advance their planning efforts into a transition process focused on refining synergies, developing functional operating models, and beginning to identify a unified approach and guiding principles for the future organization.

At this stage, parties should prepare to launch teams with leaders from both organizations for a comprehensive set of functions—from physician alignment to information technology to human resources, just to name a few—and begin to develop the governance to guide the partnership. Establishing an Integration Management Office (IMO) can help organizations centralize management of all activities (see Fig. 1).

Figure 1. Integration Management Office

Through the IMO, merging entities can further refine how the new organization will measure results, create accountability and define value. These efforts may include identifying key success metrics at the enterprise, department, and leadership levels necessary for smooth post-close execution. Other elements may include preparing reporting and tracking tools for the new organization. During the transition stage, entities should also develop detailed engagement plans—including communication plans, training, and change management programs—to proactively involve key stakeholders from both organizations.

In addition, organizations should develop transition and integration roadmaps, which can help design, drive, and monitor activities of both Day One plans as well as operational integration. The roadmaps should include checkpoints for specific tasks, escalation protocols, and responsibilities and timelines for key leaders from each organization.

Managing execution

Day One of the new organization traditionally marks the moment when the organization gains full visibility into operational and financial details that were previously limited or restricted to a black box analysis due to antitrust regulations. The organization should now be prepared to begin functioning as a single entity focused on executing the operational model and realizing the benefits of the merger. Typically, this phase lasts one to two years before normal operations commence.

At this stage, organizations should be conducting comprehensive analyses to identify, validate, implement, and track synergies and refine operating models and reporting relationships based on combined organizational data. Organizations should begin to implement the integration roadmap to form the new leadership and reporting structures, optimize operating models, and provide care as a single organization.

A synergy management program, coordinated through the IMO, can define accountability and measurement for realizing the identified benefits of the merger. In addition, communication and change management efforts should be fully implemented in concert with the combined organization’s leadership team. These efforts should include creating a system for reporting progress to the executive team or a related steering committee.

Merger Integration During a Pandemic: The Virtua Health-Lourdes Story

In July 2019, Virtua Health, a three-hospital system in New Jersey, formally acquired Lourdes Health System, a nearby two-hospital system, with the intent of creating a “New Virtua” informed by the best of both organizations and focused on high-quality, safe patient care.

The acquisition was guided by an intentional and deliberate process focused on long-term sustainability from initial transition discussions to the first day of combined operations. Starting in the initial transition planning phase, leaders from both organizations worked together on ways to create a unified system, from care optimization to culture.

“There was a high degree of expectation from the CEO, our executive leadership team, and the board,” Stephanie Fendrick, Senior Vice President and Chief Strategy Officer, Virtua Health, says. “They really supported the team in what needed to be accomplished and how quickly we needed to move.”

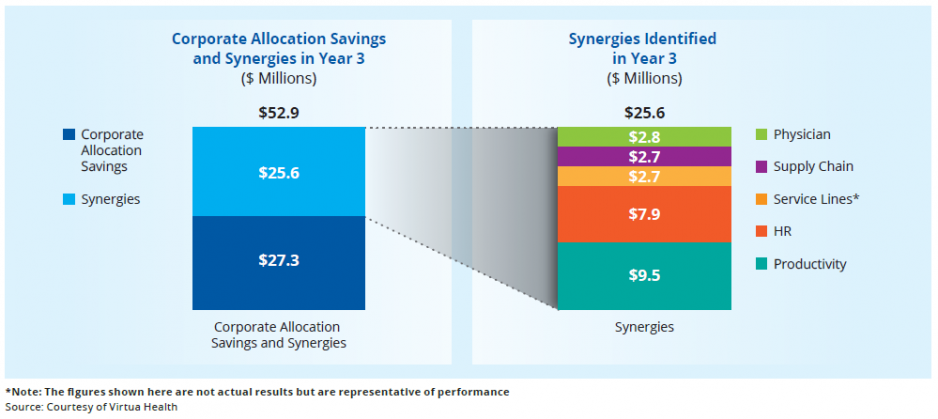

During the transition phase, Virtua leaders identified potential targets and areas of focus for building a stronger care delivery model, including leveraging Lourdes’ tertiary care and advanced clinical services. After the definitive agreement, Virtua identified and launched more than 300 specific integration initiatives, with an intent of helping realize more than $25 million (figure representative of actual performance) in synergies by year three of the new organization (Fig. 2).

Figure 2. The Organization Set Synergy Targets*

The merger gave Virtua leaders an opportunity to review approximately 3,000 contracts with vendors and suppliers and identify opportunities for both more favorable terms and potential vendor alignment and consolidation. Given differences in language, terms, and other key contract elements between merging parties, a close legal and financial review of all contracts is essential. For payer contracts, this process requires black box or restricted analytics prior to close; after close, parties should be prepared to analyze claim-level data to better understand the financial ramifications of each contract.

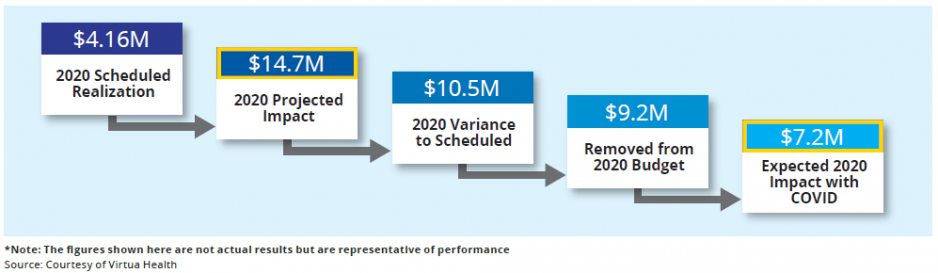

In March 2020, eight months after the combined organization began operations, New Jersey was hit hard by the first wave of the COVID-19 pandemic in the Northeast. While Virtua was forced to put many of its integration plans on hold from March to May to focus on providing care to patients impacted by the pandemic, the existing integration efforts were ultimately accelerated. For instance, Virtua moved ahead with care optimization efforts, with a focus on identifying duplicative services and evaluating consumer care preferences in specific markets.

“We looked to achieve a balance,” says Ruoran Zhang, Director of Integration, Virtua Health. “Some service lines may be appropriate to consolidate, but for others, a more distributed model is better. Considering community needs is very important for a non-profit.”

Some long-planned consolidation efforts happened organically, including the closure of some physician offices during the pandemic that were never reopened. In addition, Virtua used the list of cost reduction targets from the merger integration to help inform its response to the financial impact of the pandemic.

“We condensed to a three-year integration effort instead of five,” says Michael Capriotti, Vice President of Integration, Virtua Health. “We were very lucky that we had attacked our integration initiatives so aggressively before the pandemic.”

Ultimately, the integration planning exercise allowed Virtua officials to help mitigate the full financial impact of the pandemic (Fig. 3).

Figure 3. Prior Planning Helped Mitigate COVID-19*

Conclusion: Principles for Successful Merger Integration

Each merger integration process is unique, and should be tailored to both the future goals of the new organization and the existing operations of the merging entities. A few overarching principles can guide that process toward a successful transaction and execution of the new organization’s vision on Day One.

Integrate financial planning at the outset

All too often, merging entities approach the transaction from a primarily legal perspective. A more integrated approach that engages financial planning and forecasting early on—including creating an inventory of opportunities and a tracking infrastructure—can ensure that potential synergies and insights about future operations are included in the details of the transaction to be realized moving forward.

Empower integration teams

Prior to close, integration teams should be preparing every facet of operations for successful execution as a combined entity, from nursing to IT to human resources. Without a comprehensive approach and checklists for each functional area, merging entities run the risk of never fully realizing the value of their combination. Virtua Health and Lourdes ultimately created more than 35 transition integration teams.

Create a unified culture

Bringing together two organizations accustomed to their own practices is a sizeable challenge. For Virtua and Lourdes, maintaining Lourdes’ status as a Catholic provider required satisfying the Ethical and Religious Directives for Catholic Health Care Services for Lourdes’ future operations, including approval by the Vatican. Virtua also developed an assessment of the challenges of merging Lourdes’ faith-based approach into the existing Virtua culture.

Communicate often with staff

Achieving synergies, combining cultures, and realizing the goals of a new organization can only happen if leaders and staff are consistently communicating with each other throughout the transition and integration processes. Virtua and Lourdes developed a weekly newsletter from their respective CEOs and created a hotline for staff to voice their thoughts and concerns for the combined operations.

Improve how care is delivered

In order for a combined organization to realize its vision of providing high-quality care, identifying best practices for how care is delivered while leveraging the strength of each organizations’ existing operations is essential. For merging entities with duplicative service lines, consolidating services can not only reduce costs, but can address variation in care and lead to improved quality. In other instances, consumer preferences in a given market may require the continuation of specific service lines in multiple locations. This process requires a careful evaluation of service line performance at both entities, and a multi-year plan for care integration and optimization informed by administrators and physician champions.