Health systems today find themselves in a new environment.

The business model. Care delivery is shifting from inpatient to outpatient services: For Medicare patients alone, the amount of revenue derived from outpatient services is now almost equal to revenue from inpatient services. Adding commercially insured patients to this mix would almost certainly tip the balance in favor of outpatient. Expense containment initiatives help offset some of these revenue pressures, but overall business model transformation is likely to have a significant impact on an organization’s credit position and its debt capacity.

The investments. The form and structure of investments are changing. In addition to “traditional” asset-based capital, more organizations are making major initiative investments that have a material impact on income statement performance. This may significantly adjust credit position or the composition of credit and it also will likely impact both the source and amount of debt capacity.

The competition. As the healthcare business model changes, health systems become more vulnerable to new market entrants unburdened by legacy inpatient service costs and often backed by private equity investors or the capital resources of large national companies such as CVS Health, Amazon or Walmart. As these new competitors move into the market, health systems will have to reconsider their definition of “peer organization” and the metrics they use to evaluate performance and define success.

The investors. Investors and capital markets are becoming increasingly sophisticated in response to these changes. The rating agencies are keeping pace, viewing their credits through the perspective of refined qualitative and quantitative reviews that bring both greater transparency and greater complexity to rating analyses.

The need to adapt

It is a basic principle of evolution that, as environments change, so too must the characteristics and skills of the species within that environment. Health systems within the evolving healthcare marketplace also need to adapt, which will require the following:

A more sophisticated understanding of your organization’s story

Rating agency efforts to bring greater transparency to their methodologies have sparked debate on what is truly important for an organization’s credit and have reinforced the significance of qualitative factors. A more sophisticated understanding of your organization’s market and its position within it is needed.

Better data and analytics

Health systems need real-time data and analytics to better understand organizational and environmental trends as they are happening and to better inform the organization on how credit, debt, and capital capacity will be affected over the near and medium term.

A developed point of view

The ability to tell your organization’s story also depends on a point of view that incorporates positions on your organization’s relative strengths within a dynamic market, the importance of achieving or maintaining a certain credit rating, the organization’s most significant operational risks, its short- and long-term strategic priorities, and its appetite and tolerance for capital and credit risk.

Different resources

As new strategies and tactics emerge, the need for new resources—ranging from intellectual skills to financing tools—becomes critical. Securing these resources may impact credit performance and may trigger the need for different partners, different capital access, and ultimately a different way of deploying credit and debt capacity.

Implications for developing your organization’s perspective on debt capacity

Debt capacity also must evolve to reflect a more nuanced understanding of internal risk management and external access and cost considerations. Debt capacity is dynamic, determined by a blend of quantitative and qualitative factors that are unique to each organization. A reassessment of debt capacity flows naturally from the process of developing your organization’s point of view on its current and future market positions, balancing the organization’s capacity to fund its near- and far-term strategies with its desire to maintain a “corridor of control” within its newly articulated risk parameters and desired credit position.

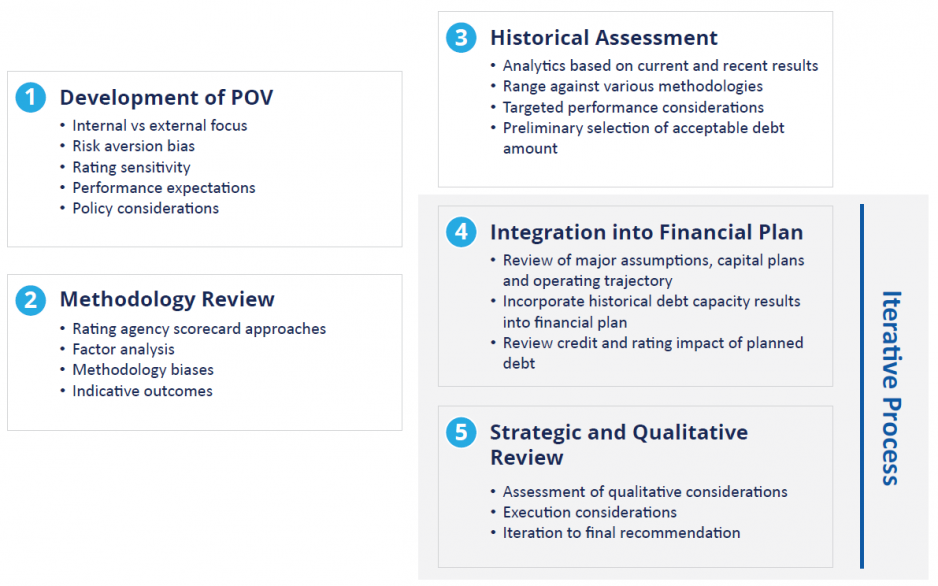

FIGURE 1: A FIVE-STEP PROCESS FOR ASSESSING DEBT CAPACITY

A reassessment of organizational debt capacity requires a five-step process (Figure 1). This process articulates the organization’s point of view on debt, incorporates perspectives from the broader market, integrates the evolution in credit analysis, and reinforces the iterative nature of debt capacity within the organization’s current and desired future financial position.

Step 1: Develop point of view on external debt

The first step requires a full and frank assessment of your organization’s position on external debt. Key questions include the importance of achieving a certain credit rating, the level of sophistication of organizational leaders and board members on debt capacity, the presence of ongoing risks in areas such as pension liability, and external factors that could strongly influence debt decisions, such as community image, board composition or sponsorship.

Steps 2 and 3: Balance external investor perspectives with internal risk management

Next, organizations should understand how a change in debt capacity would be viewed through external investor perspectives, particularly the perspectives provided by the credit rating agencies. Each rating agency has its own methodology to determine credit ratings. Using guidance from the rating agencies, this step in the process estimates at what point additional debt would negatively impact the organization’s rating or take the rating below the minimum rating the organization wants to maintain. Rating agency perspectives should be balanced with an internal perspective on risk parameters, as defined by key indicators of coverage, liquidity, and capitalization. While it may be tempting to focus only on credit scorecards in determining an organization’s debt capacity, the organization is ultimately responsible for its debt and must understand its own comfort level.

The results of this analysis are then run against the organization’s historical financial performance to highlight an existing range of debt capacity. The numbers will differ depending on the methodology applied, but together will provide a range from which an appropriate debt capacity “number” can be identified based on the organization’s point of view on external debt. Because it is based on historical performance, this number should be treated as a starting point, reflecting what is possible today but not yet accounting for projected future performance.

Step 4: Test capacity for additional debt against near- and far-term plans

From a starting point of historical debt capacity, debt issuance assumptions should be flowed through the organization’s financial projections. This step incorporates the organization’s capital plans, perspectives on future market position and profitability, and corresponding changes to the balance sheet. This is an iterative process, balancing organizational risk tolerance, cost and access considerations, other uses of cash and the funds required to support organizational strategy, and adjustments will likely be necessary to determine an optimal future debt capacity range.

Many organizations are contemplating major investments to address industry disruption. A deep, forward-looking view is essential to test and demonstrate the ability to support the organization’s capital structure in a volatile environment, especially if the organization seeks to go beyond its historical or current debt capacity. It is important to remember that funding new initiatives through equity or external leverage can adversely affect performance against key credit ratios. The question attached to the assessment of any funding strategy is frequently less about the immediate impact on ratios and more about how quickly recovery occurs (i.e., whether short-term rating dilution ultimately translates into long-term ratio improvement).

Step 5: Consider qualitative factors that “risk adjust” assumptions on ability to bear incremental debt

The final step “comes up from the numbers” and considers other qualitative factors that could affect the results of the analysis and projected impacts on credit outcomes. These factors could include the competitive environment, management stability, relative risk of strategic plans and any other factors that could have a material impact on the organization’s ability to bear incremental debt. This too is an iterative process, and the organization likely will want to consider the potential impact of several scenarios.

Additional considerations

Evolution and adaptation go hand in hand. Health systems should consider leveraging all available resources to maintain their competitive advantage as the healthcare market evolves. Credit and capital capacity are critical resources as health system leaders strive to adapt their organizations to constantly evolving conditions. An approach that balances real-time quantitative measures with deep qualitative insights, and external perspectives with internal points of view, is necessary to produce an outcome that addresses the specific credit and capital needs of specific organizations in a changing environment.

A shorter version of this article was published in the December 2019 issue of hfm Magazine.