There has always been a connection between performance improvement initiatives and the balance sheet. By reducing operating costs, boosting productivity, and enhancing revenues, a successful performance improvement initiative will bolster the financial performance of the organization. This in turn grows financial reserves, increases debt capacity, and builds headroom for covenants (e.g., minimum days cash on hand, required debt service coverage ratios) for existing debt obligations.

The balance sheet need not be only the beneficiary of performance improvement initiatives, however; it too can be optimized to contribute to performance improvement goals. Improvement opportunities exist within the organization’s debt structure, treasury operations, and real estate portfolio. The goal is not only to identify opportunities to reduce costs or improve efficiencies, but also to ensure that balance sheet resources are positioned to best serve the organization’s needs (Figure 1).

Figure 1: An Expanded View of Performance Improvement Opportunities

Debt structure opportunities

The opportunities within an organization’s debt structure lie in two main areas. First are opportunities to refund or restructure existing debt. Second are opportunities to manage covenants on that debt to avoid potential default or minimize the consequences of a covenant breach.

Identifying opportunities within the organization’s existing debt structure begins with developing a comprehensive catalog of current debt obligations, including par value, maturity and call dates, debt structure (e.g., fixed rate, line of credit, etc.), rates, and covenant sources (e.g., master trust indenture or private placement debt). A summary of covenants across the various sources should also be included to identify potential covenant challenges.

An organization may have opportunities to modify debt service requirements or to refund debt with particularly onerous covenant requirements. Working with creditors to restructure principal amortizations of debt is also a possibility, particularly for organizations facing financial difficulties.

To the extent that financial performance is threatening the potential breach of covenants in existing debt obligations, the catalog of covenant sources and summaries will help identify where a potential breach might occur and the total outstanding debt that might be affected. Proactive identification of problem areas enables the organization to identify potential remedies before the breach occurs or to begin early conversations with creditors and rating agencies to identify alternatives such as amendment, waiver, or forbearance.

Treasury operation opportunities

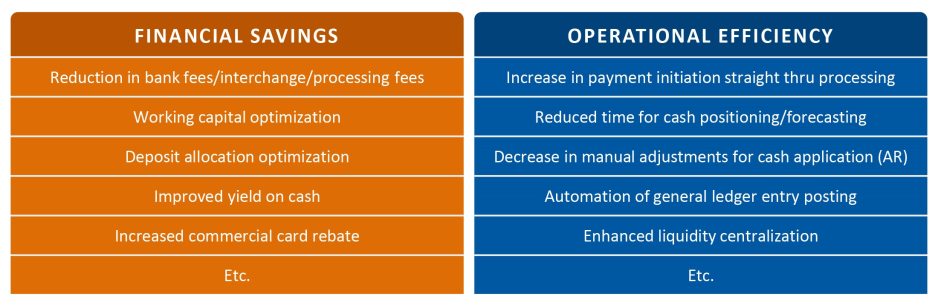

Treasury operations hold opportunities both for financial savings and for improved operational efficiencies. These opportunities are grounded in a thorough understanding of the current state of the organization’s treasury operations, including the treasury systems currently in use, key treasury partners, and the organization’s business priorities. Results from the current state analysis can then be benchmarked against leading industry insights and best practices in a gap analysis to identify attainable targets for value generation.

Financial savings are generated through reduction of costs, improvements to working capital, and increased returns on operating and reserve cash. These goals can be achieved by, for example, initiating a banking RFP to reduce fees or optimizing a commercial card program to enhance rebate terms with card issuers.

Increased operational efficiencies can result in improvements in key performance indicators, streamlining of end-to-end workflows, and reductions in manual processes. Automation and various software solutions can be particularly effective interventions to increase efficiencies, reducing time for cash positioning and forecasting, automating general ledger entry posting, and decreasing the need for manual adjustments for cash application in the accounts receivable process.

Additional opportunities for both financial savings and operational efficiencies are described in Figure 2.

Figure 2: Performance Improvement Opportunities in Treasury Operations

Real estate opportunities

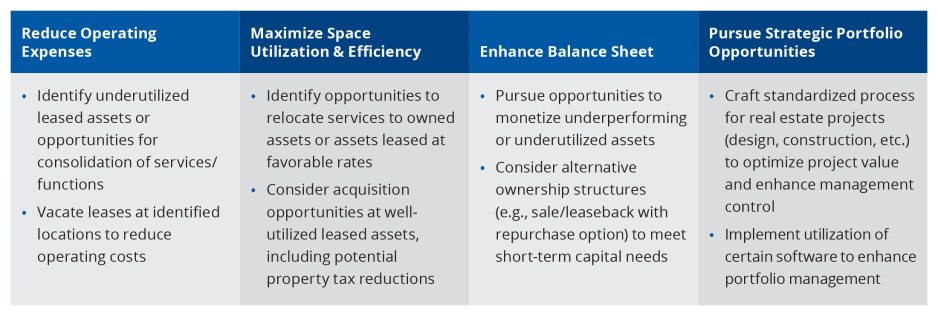

For almost all health systems, the real estate portfolio holds significant opportunities for operating cost reductions, efficiency improvements, and access to unrestricted liquidity, given the scale of real estate exposure that most health systems have amassed. A mid-sized health system may have millions of square feet in owned and leased assets, and a sizeable portion of that may lie beyond the system’s main hospital facilities in medical office buildings, ambulatory clinical assets, post-acute facilities, administrative office space, and other real estate holdings.

The first step for any health system seeking to optimize the performance of its real estate portfolio is establishing a comprehensive inventory of all the system’s owned and leased assets. Even health systems that have a dedicated real estate management department may lack a robust catalog of the portfolio is often lacking, given complexities in organizational structure, focus, and oversight.

Once a comprehensive inventory is in place, the portfolio can be segmented and organized by asset type and other key characteristics. Relevant factors include:

- Utilization (clinical, office, etc.)

- Location (including proximity to the main campus or other care assets)

- Ownership interest (e.g., full or partial, joint venture or condominium)

- Lease expiration or renewal dates

- Current occupancy or utilization rates

- Current rental rates and valuations for relevant markets

- Age of the asset

A comprehensive and organized view of the real estate portfolio allows management to make informed decisions on an asset-by-asset basis across the portfolio based on quality, location, utilization, and cost, among other factors. Most importantly, the information derived from this process enables management to optimize the performance of real estate portfolio assets and utilize the real estate portfolio to meet key strategic financial and operational goals (Figure 3).

Figure 3: Sample of Performance Improvement Opportunities for the Real Estate Portfolio

Conclusion: An optimized balance sheet

By extending performance improvement initiatives to the balance sheet, organizations can tap new opportunities for expense savings, enhanced returns, improved liquidity, and operational efficiencies. In the process, they can reposition balance sheet resources to ensure that they are making the greatest possible contribution to the organization’s ongoing financial health.