In the pre-pandemic era, payer-provider partnerships were often focused on aspirational goals of creating partnership value by managing costs of care and delivering high-quality care. Payers and providers aimed to drive differentiation and growth through these partnerships. In today’s more challenging macro-economic environment, these conversations are becoming more direct and practical, with both payers and providers asking hard questions about value, including:

- Where is the real value “unlock”?

- How do we create and realize this value?

- How do we capture value in ways that adequately compensate participants for their contributions?

- Who are the right partners to work with?

Reset or Evolution?

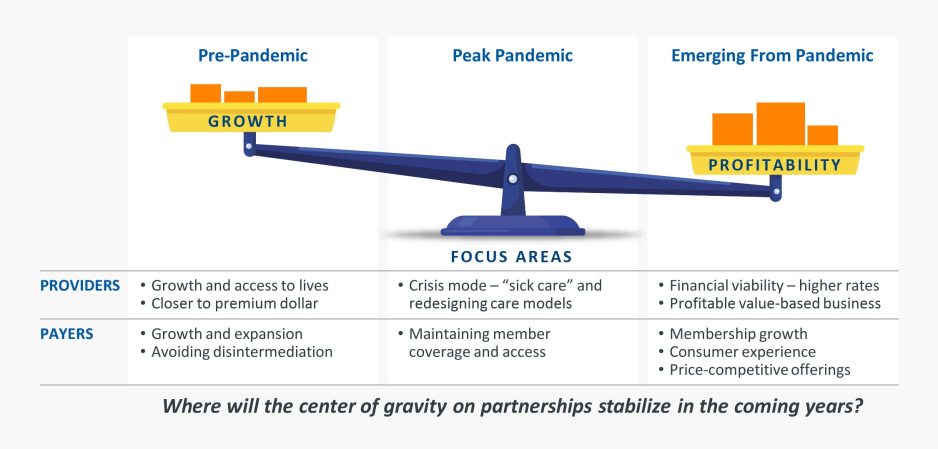

The fundamental nature of the questions being asked is leading to a shift in the ways in which payers and providers alike view and evaluate their partners. Providers and payers have reset their focus in partnerships accordingly in recent years. While providers increasingly desire financial viability and profitability in the form of higher reimbursements and yields net of denials and downgrades, payers are increasingly seeking membership growth in a largely flat commercial market, a superior consumer experience, and price-competitive offerings (Fig. 1).

Figure 1: The Center of Gravity on Payer-Provider Partnerships Has Shifted

At the same time, the post-pandemic renegotiation of many payer-provider contracts has often been contentious, with each side attempting to optimize their contracts to drive revenue growth in support of a return to profitability. These near-term pressures illuminate the need for the “win-win” growth of successful value-based payer-provider arrangements (it is our experience that most organizations remain steadfast in their commitment to value-based care).

As payers and providers alike reassess their relationships in the current climate, each group is looking for partners that stand out from their competition and bring substantive capabilities to the table. In the long term, payers and providers alike may prioritize a smaller number of strategically aligned partners in a given market.

What Do Payers and Providers Want From Each Other?

The terms and capabilities providers seek from their payer partners include:

- A fair reimbursement for services, including reasonable rates and trends but also agreements on other factors that affect net revenue yield like denials and downgrades

- Capabilities and expertise in the transition to value-based care, including risk-sharing expertise and other “enablement” type services

- Expertise in specific joint ventures; for instance, a payer might have expertise with sales and marketing, regulatory compliance, and risk-based capital management for Medicare Advantage

- A willingness to eliminate barriers to yield capture and reduce cumbersome processes around prior authorizations and claims processing

- Assistance with care transitions, so that hospitals can move patients to alternative sites of care after their inpatient journey, and potentially make a dent in stubborn length of stay issues

- Support for increasing “keepage” and enabling members in the payer’s network to get their care from the partnering provider / health system – both plans and providers want to be “advantaged” in certain instances

What payers want from providers:

- A recognition that societal ability and willingness to continue to keep investing in growing healthcare costs is increasingly challenged and may be at a breaking point in some markets (a recent Wall Street Journal article cited Mercer and Willis Towers Watson surveys that project costs for employer coverage are expected to surge around 6.5% in 2024)

- Commitment to value and reducing the total cost of care and bending the medical cost trend

- Awareness that disruptive innovation is everywhere, and many of these so-called disruptors are targeting the most profitable lines of business and market segments

- Willingness to “think big” and completely re-architect their care models to drive value-based care, which might include:

- Understanding true root causes of healthcare costs, including societal and community drivers of costs and related health inequities

- Designing new care models that truly address these root causes (these care models may not be “adjustments” to the existing model, but a fundamental rethink of what care delivery should look like to address the identified root causes, often incorporating technology and/or significant business model changes)

- Addressing care gaps in the marketplace including provider bottlenecks such as access to primary care

- Transitioning to lower cost sites of care, including ambulatory surgery centers, virtual and in-home care options

- Adjusting physician compensation toward value-based care

- Recognizing that the center of gravity in a health system may need to shift from inpatient to physician office/home/community settings in a true value-based environment

Joint Opportunities

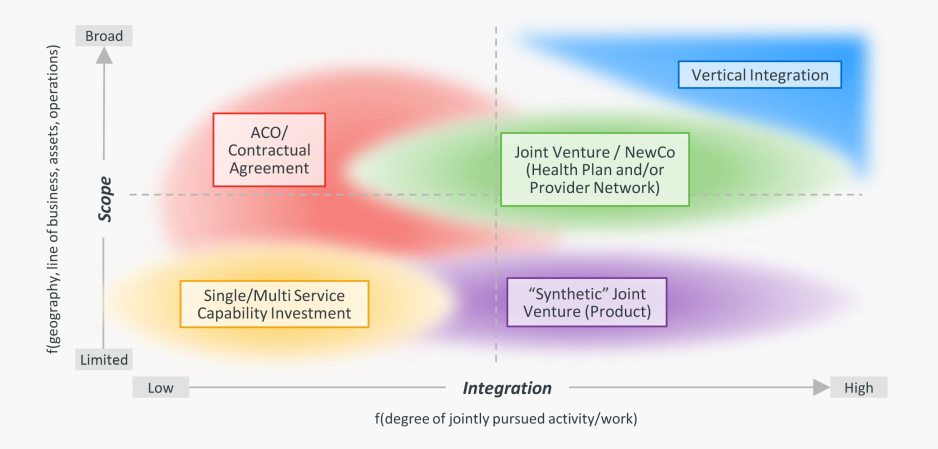

Payers and providers have a wide range of opportunities they can pursue jointly, as indicated in Figure 2 below. These opportunities vary on several dimensions, with the most meaningful distinctions being in the scope of the opportunity and the degree of integration it requires of the participants, which are represented by the two axes of Figure 2. We depict five categories of potential opportunities in Figure 2, recognizing that many other variations are possible.

Real-life case examples currently exist in each of these five categories. For example, in the Pacific Northwest, MultiCare and Premera Blue Cross collaborated to launch Peak Care, a product for the commercial employer segment. In the Mid-Atlantic, Horizon BCBSNJ entered into a Medicare Advantage joint venture with Hackensack Meridian Health System and RWJ Barnabas Health System, two of the largest health systems in New Jersey. Also in the Mid-Atlantic, in the general category of vertical integration opportunities, Highmark Health acquired a minority interest in Penn State Health, as part of a broader partnership between the two organizations.

Figure 2: Spectrum of Constructs Across Dimensions of Relationship Scope and Level of Integration

The partnership opportunities payer and provider organizations prioritize going forward should be thoughtfully customized to their situations, including the needs in the local market / community, competitive and regulatory forces in play, strategic priorities and capability maturity of the organizations, and the prior history and relationship between the organizations.

Conclusion

Most payers and providers have made some investment in value-based strategy and infrastructure,

but few have seen the strategic and financial returns they aspired to or require going forward, given the growing affordability pressures in the healthcare system. Plans and providers are pursuing “reset” strategies in the face of macro-economic challenges and shortfalls associated with their existing fee-for-service and value-based care arrangements. Future success in value-based models will require both payers and providers to make real choices, establish preferred relationships and make strategic investments that extend beyond traditional infrastructure.

Given the current challenging financial realities, contention in payer-provider relationships is likely to continue in the near-term before equilibrium is reached. Beyond that period, payers and providers will need each other in this new era of transformed healthcare financing and delivery. Contention over an extended period of time could be highly detrimental to both sides.

Ultimately, it’s likely that payers and providers will emerge from this period with deeper partnerships with a smaller set of players on both sides. Payers and providers that can differentiate themselves from their peers and deliver the results their constituents seek are more likely to thrive in more competitive local markets. Thoughtfully, creatively, and effectively balancing strategic objectives and financial realities will be essential to determine the right payer-provider partnership strategy for the future.