As health systems continue to face intense operational and financial pressures, performance improvement initiatives must reach all aspects of the organization. Often overlooked in performance improvement efforts is the real estate portfolio, both owned and leased. Management may perceive real estate as a relatively static resource and may not even realize the full extent of portfolio resources available. For almost all providers, however, this portfolio holds significant opportunities for operating cost reductions, efficiency improvements, and access to unrestricted liquidity given the scale of real estate exposure that most health systems have amassed.

Assessing the real estate portfolio

Healthcare is accurately described as a capital-intensive enterprise, and much of that capital is allocated towards the real estate portfolio. A mid-sized health system may have millions of square feet in owned and leased assets, and a sizeable portion of that may lie beyond the system’s main hospital facilities in medical office buildings, ambulatory clinical assets, post-acute facilities, administrative office space, and other real estate holdings.

The first step for any health system seeking to optimize the performance of its real estate portfolio is establishing a comprehensive inventory of all the system’s owned and leased assets. We find that, even for systems that have a dedicated real estate management department, a robust catalog of a system’s portfolio is often lacking, given complexities in organizational structure, focus, and oversight. Creating a comprehensive inventory often requires a combination of existing data on the portfolio and interviews with key management leaders to expand on existing—or fill in missing—information on the portfolio.

Once a comprehensive inventory is in place, the portfolio should be segmented and organized by asset type and other key characteristics. Relevant factors include:

- Utilization (clinical, office, etc.)

- Location (including proximity to the main campus or other care assets)

- Ownership interest (e.g., full or partial, joint venture or condominium)

- Lease expiration or renewal dates

- Current occupancy or utilization rates

- Current rental rates and valuations for relevant markets

- Age of the asset

A comprehensive and organized view of the real estate portfolio allows management to make informed decisions on an asset-by-asset basis across the portfolio based on quality, location, utilization, and cost, among other factors. Most importantly, the information derived from this process enables management to optimize the performance of real estate portfolio assets and utilize the real estate portfolio to meet key strategic financial and operational goals.

Identifying performance improvement opportunities within the real estate portfolio

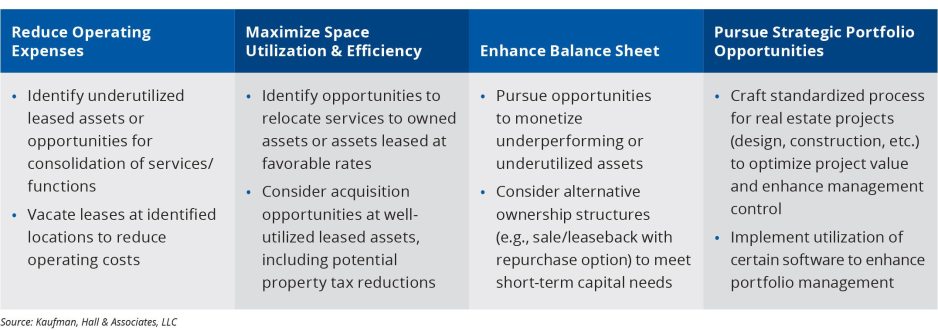

Typical goals of a performance improvement initiative include reducing operating costs, increasing operational efficiencies, and freeing up resources that can strengthen the organization’s balance sheet to support its strategic initiatives. The real estate portfolio can be deployed to meet specific goals (Figure 1).

Figure 1: Sample of Performance Improvement Opportunities for the Real Estate Portfolio

Not all these opportunities will be immediately available: unlocking value within the real estate portfolio can depend on such factors as lease terms, current market conditions, and the presence of a willing counterparty (e.g., landlord, buyer, or seller). But even if an opportunity is not immediately available, active management over the near- and long-term of the real estate portfolio can flag opportunities to monitor as leases expire or come up for renewal or as market conditions change, positioning the organization to act quickly as opportunities emerge.

Conclusion: Activate the real estate portfolio to achieve performance improvement goals

At a time when most hospitals and health systems can afford to leave no stone unturned, the real estate portfolio represents a significant—and often underutilized—resource that can be deployed to help achieve the organization’s performance improvement and other goals. By building a comprehensive inventory of portfolio assets, identifying the key asset characteristics that drive value for the organization, and actively monitoring the portfolio for new opportunities, management can identify, capture, and create value in both the short and long term.

For more information, please contact Hunter Beebe, leader of our Real Estate Practice, at hbeebe@kaufmanhall.com.